It's Later Than You Think

Some sobering thoughts about retirement

I believe that one of the biggest slow-moving crises that this country faces is the low overall level of retirement savings, especially for individuals who are on the cusp of retirement. Over the next 10-15 years, this crisis may very well become acute. Given the general inability of our political system to address important problems, I do not hold out any great hopes for an effective public policy response.

According to this, the median retirement savings for Americans in their 50s is $117,000. This means that half of Americans in their 50s have less than that amount saved. This age cohort is facing down retirement with an asset base that is frighteningly inadequate to the number of years they will live in retirement.

According to the Social Security actuarial life expectancy tables, a 55 year old man is expected to live 25.5 more years; a woman, approximately 28 more years. Assuming a withdrawal of $20,000 per year, and a rate of return of 4%, that money will be gone in less than 7 years. Social security will provide key additional income to retirees, but our system of retirement finance was never meant to be fully-supportive. It was meant to be a “three legged stool,” with the other legs of the stool being employer pensions and personal savings. Defined benefit employer pensions are, for most people, a thing of the past. As noted above, personal savings are modest to non-existent for many people.

I hear you: you say that a person in their 50s has more time to work. More time to accrue assets. I say: It’s later than you think. The average retirement age in the US is about 65 for men and 63 for women. “Full retirement age” for the purposes of collecting Social Security is 67. But here is an important point: for many people, retirement will be involuntary. Many people will not have the luxury of deciding when they are done working. They may be physically incapable of continuing to work, and be forced to retire as a result. Others may lose a job later in their careers and be unable to find another. It is a fantasy to think that the basis for even a modest retirement can be built in the last years of one’s working life.

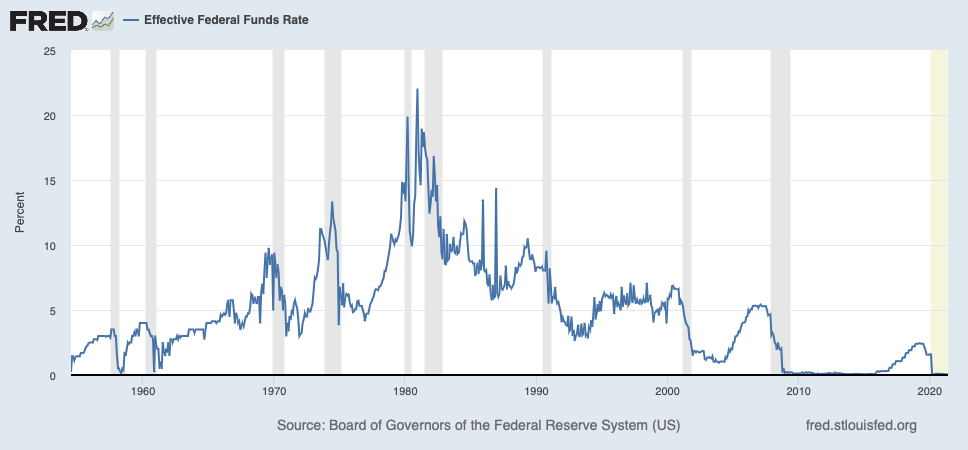

Another important piece of this puzzle is asset returns. For more than a decade, we have been living in an environment characterized by extremely low yields, especially for fixed-rate assets which traditionally made up the base of a portfolio for retirees. This means that it is virtually impossible to garner meaningful income, even from a large portfolio of fixed-income investments. Coupled with increasing life expectancies and an increase in the number of years people can expect to live in retirement, retirees now need larger initial portfolios, and need to invest in riskier assets than they traditionally did, all to generate a similar level of income. With the possibility of increased inflation, retirees could see the real purchasing power of their incomes decline further.

The saying that “the best time to plant a tree was 20 years ago. The second best time to plant a tree is now” describes this situation perfectly. Assets need time to grow and compound. Time is the best ally a person has in building a meaningful portfolio. I try not to come across as too much of a doomsayer in all of this, but the convergent factors of lower expected asset returns and miniscule savings means that many people will lead less comfortable lives in retirement than they expect. It is especially important for people in my age cohort (mid thirties) to begin saving aggressively if they have not started already. There is still time to build a portfolio that can provide meaningful retirement income. If nothing else, take away these points:

We are not in this together. Nothing about how our political system operates should make you think there will be any effective public policy response to the looming retirement crisis.

No one will give you a loan for retirement. You need the cash up front. The only way to build a portfolio that can support your lifestyle in retirement is to save and invest for decades. Five or ten years is not enough time to build a portfolio.

It is later than you think. Assets need time to grow, and you should assume that average asset returns for the next decades will be lower than they were for the preceding decades.